Our Case Studies

A proven track record is the best way to demonstrate our strength and depth of expertise. Below are examples of our team’s recent appointments.

Mining and Metals

Chrome and Platinum Mine

Umnotho weSizwe Resources (Pty) Ltd (“UWR”), based in South Africa, owns and operates a chrome and platinum group metals mine with proven reserves of 20 million tons of premium grade chrome.

UWR began developing the mine in 2010 and started production in April 2011. However operational challenges as well as poor commodity prices led the shareholder to place the company into Business Rescue during February 2013, in terms of Section 131 of Chapter 6 of the Companies Act.

A refinance agreement was put in place to settle all pre-commencement claims and fund the ongoing running of the mine whilst the business rescue plan was implemented. Operational changes to the mine were implemented including, as well as finding a new investor and restructuring the existing bank debt.

The mine has now changed name and is currently operational and profitable and contributing to the local economy in a meaningful manner.

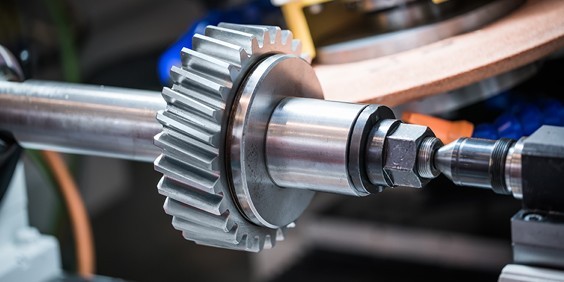

Manufacturing and Engineering

Evraz Highveld Steel and Vanadium Limited

Evraz Highveld is the second largest steel manufacturer in South Africa. It is the country’s only producer of heavy structural steel products and only one of five such companies in the world.

In 2015 the Board and management advised that the firm did not have sufficient funding to meet its financial obligations for the short term as a result of historical operational and financial difficulties and extremely difficult steel and vanadium market conditions. It was resolved to place the company into Business rescue.

Initially an accelerated M&A process was entered into, in order to find a strategic investor, and ways of reducing costs were implemented. Several independent environmental specialists were appointed to evaluate and assess the potential environmental liability and a rotational lay off agreement was entered into with the unions, and later, a full retrenchment of all the staff.

In an attempt to preserve value, an application was submitted to the International Trade Administration Commission (“ITAC”) for import price protection. Several private and governmental entities were approached in order to obtain post commencement funding.

The process is currently still underway.

Mining and Metals

Optimum Coal Holdings and Optimum Coal Mine

In 2015, the board of directors and management of Optimum Coal Holdings and Optimum Coal Mine resolved to place both the companies in Business Rescue due to operational and financial difficulties and extremely difficult coal market conditions.

We were able to negotiate on supply contract pricing as well as entering into an accelerated sales process in order to find a strategic investor.

A strategic investor was found to settle the senior bank debt of R2.5bn and over 3 000 employee and contractor jobs were saved.

Retail and Distribution

Ellerine Furnishers (Pty) Ltd

Ellerine Furnishers (Pty) Ltd, a retailer of furniture and household appliances , commenced with Business Rescue in 2014. This has been the largest Business Rescue to date, based on the Public Interest score of the Company. The firm employed almost 8000 people and had operations in six African countries, comprising over 1000 stores.

In 2010 the provision of credit and financial services component was sold to African Bank. This resulted in a significant decrease in the Company’s income and profitability. A decision was taken that no further funding would be provided by ABIL or African Bank in August 2014 and it was thereafter resolved to place the company into Business Rescue.

Ellerine Furnishers held a deposit of R472million with African Bank that would have been utilised as Post Commencement Funding (PCF). However, the Bank was placed under Curatorship less than a week after the commencement of the Business Rescue. With no accessible funds in the bank accounts, there was an urgent need to secure PCF

PCF was eventually secured after extensive discussions with African Bank. Store closures, realisation of stock and sales of part of the business have all been carried out, saving approximately 2000 jobs to date.

The dividend paid to creditors to date has far exceeded the ‘best case’ dividend that creditors would have received in liquidation and it is estimated that the final dividend will be approximately 42c in the Rand.

Mining and Metals

Deepwater Horizon

GlassRatner Advisory & Capital Group, LLC was retained by the United States Department of Justice in its Clean Water Act penalty lawsuits against BP Exploration & Production, Inc., a subsidiary of BP p.l.c., and Anadarko Petroleum Corporation related to the Deepwater Horizon oil spill in the Gulf of Mexico.

GlassRatner provided litigation support services and performed financial analyses regarding the economic impact on the defendants’ and each defendant’s ability to pay a multi-billion dollar penalty. GlassRatner provided five separate reports in this matter, including rebuttal reports, and Mr. Ratner testified for over 6 hours during the multi-week trial.

After the trial, BP Exploration & Production, Inc. entered into $20+ billion settlement with various governmental agencies. This settlement included $5.5 billion for the Clean Water Act penalty. A $160 million Clean Water Act penalty judgement was issued by the Court against Anadarko Petroleum Corporation, even though Anadarko had no operational involvement and was only an investor in the project.

Manufacturing and Engineering

Integrated Distribution & Print Business

Farber’s multi-disciplinary team were engaged by the private equity fund/shareholder to provide advice and guidance to the Board of Directors and management team as the Company operated through a financial and operational turnaround.

Our duties included assessing and building the management team, advising on all financial and cash flow implications as well as assisting in all aspects of operational performance improvement.

Farber were able to develop strategy, including closing facilities and building sales capabilities and recruit a new CEO and sale staff, resulting in a 20% improvement in productivity and ensuring the cost of capital is optimised. Farber are continuing to provide support for finance and operations of the business.

Manufacturing and Engineering

Leader in the single home construction business

A receiver appointed by the court asked Zalis to guide a home builder ranked number 2 in France, out of its cash flow crisis.

Zalis assisted the management and shareholders to deal with a business slowdown, using a large operational team to audit the group (and its different business units spread across France) and to build an action plan to rescue the business.

The resulting action plan was implemented over a full year. Once the rescue had proved successful, a buyer was found for the company.

Hospitality, Leisure and Sport

Leader in the casino business

Zalis ran the restructuring of a French leader in the gambling industry. Daniel Cohen, CEO and founder of Zalis, and his team advised and supported the company in connection with its second equity capital raising and assisted in its operational and financial restructuring, in particular through an agreement reached with a large banking pool.

The support of Zalis resulted in a debt rescheduling (thereby avoiding asset sales in a difficult market), a new capital increase and a change in governance.

Improved financial results have confirmed a successful turnaround.

Aviation

Top Tier 1 aerospace producer

Deal origination and advisory services for two large U.S. Private Equity firms to enable them to become the anchor shareholders of a Tier 1 subcontractor in the aerospace industry.

Zalis identified a company with good fundamentals that was over-indebted and loss-making and had a highly diluted shareholder structure. In order to secure the future of the company, Zalis approached some investors with this opportunity. Two funds showed a strong interest and jointly hired Zalis to conduct a confidential industrial and strategic survey before making their investment decision. Some of the root causes behind the company’s underperformance were identified and the turnaround potential analysed.

Zalis advised the funds throughout the whole process. In particular, advising the U.S. investors on their relationships with the French Authorities. The management turnaround plan was challenged, and organizational improvements and measures to prevent the loss of skills were suggested. Finally, through a Debt to Equity swap and New Money investment, the two funds became anchor investors.

Financial Services

Project Jetway

A financial institution was suspected by the United States Senate of being involved in money laundering, drug trafficking, and terrorist financing activities.

The local financial services regulator engaged us as an independent examiner to inspect the Cayman licensee’s compliance with the applicable anti-money laundering and counter financing of terrorism laws and regulations.

The investigation focused on whether the licensee had appropriate and sufficient anti-money laundering policies and procedures and adequate identification procedures.

Various issues arose during the inspection, which we were able to overcome and produce a comprehensive report for the regulator within the deadline imposed.

Find an Expert

Find the right professional using the below dropdowns. Our reach covers the globe with a network of over 300 offices.

Or, browse by location

Latest News

View All Latest News25/03/2025

BTG Global Advisory Holds AGM in Hong Kong

BTG Global Advisory held its AGM on March 20-21, 2025, at the Kowloon Bowling Green Club in Hong Kong. The meeting brought together senior partners, managing directors, and financial experts from around the world to discuss strategic initiatives for future growth. As a leading international alliance of independent advisory firms, BTG Global Advisory continues to expand its influence across markets, addressing emerging trends and industry challenges.

10/03/2025

UK Care Homes: The UK’s ageing population is a shared challenge and opportunity

The UK’s care home market is undergoing substantial evolution, presenting opportunities for investors amid growing demand and complex structural headwinds. While an ageing population intensifies pressure on the NHS with rising waiting lists and increased prevalence of chronic health conditions, it also drives significant investment appeal in the care sector.

27/02/2025

UK construction: fragile confidence in a sector awash with rising costs and uncertainty

The UK construction sector is grappling with persistent headwinds. Growth in construction business activity has softened to the slowest pace since June 2024, according to the S&P Global UK Construction PMI. Headline construction PMI fell to a six-month low of 53.3 in December.

25/02/2025

UK Trade: risks and opportunities in a diverging two-speed economy

The UK’s annual trade deficit narrowed by £14bn to £25.1bn in 2024, according to the latest ONS data. However, this masks a growing divergence between services and goods trade. Services exports remain a bright spot, while goods exports continue to decline, deepening the UK’s two-speed economy.